The S&P500 is not doing any movement, not a good Market to make money, but there are other Markets we should follow; profits are profits, no matter from where they are coming...

In trading it is normal to get attached to a Market. I was in love with the S&P500, then I discovered Grians Markets, then other Commodities, and now I love all of them. Being in love with only the S&P500 is not a good thing on these days, because the low volatility is the worst enemy for a trader; we all know the volatility of the S&P500 is really horrible right now! But tomorrow the wind will change due to the FOMC Statement; also many grains markets, like Wheat and Corn, are not offering a good volatility.

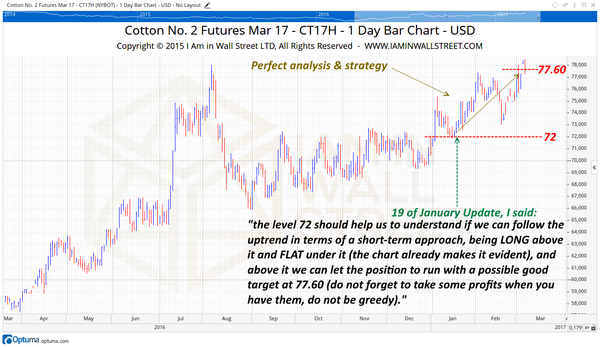

In 2017 we have introduced a new Market: Cotton. We provide a forecast model with constant updates over the year. The first update was on the 19th of January 2017, you can download it in this page:

If you read the Update you see we said to expect an uptrend, where we had to buy with stop under 72, and possible target in area 77.60. The strategy was perfect (we are not trading the March 2017 Contract anymore, the May Contract details are in the last Update).

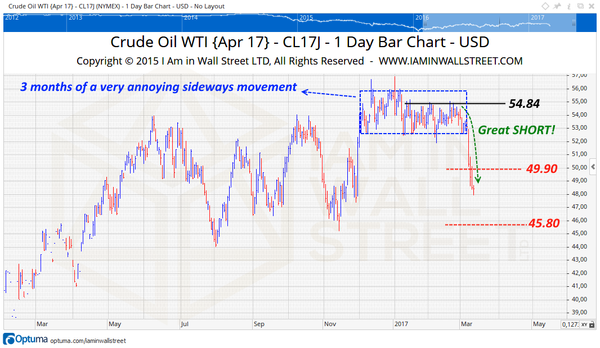

Another good Market, but very hard to handle, is Crude Oil WTI. We said to expect a descent from this Market, and I said it 3 months ago! Unfortunately there was no point to see the end of a never ending sideways movement... until last week!

In our Reports, we said to use the April Contract with the Key Price 54.84, always SHORT under it and FLAT above it. The strategy was good, and not so hard to understand! We said to play with the Market under 54.84, opening SHORT positions at the resistance and taking some profits at lower levels, but remaining always SHORT with a part of the investment because of the expected down trend. It was a long wait, I know, but totally worth in the end! The levels in red are the possible mid-term levels where to find supports/resistances.

We deal with different Markets, and this is good when we have to manage a big portfolio. We have closed a great trade with Gold, from 1180 to 1258, but it is a lie if I tell you that in the last months we made money with every Market we trade! Grains have a low volatility, Soybeans are better than Corn and Wheat, but very choppy anyway, so, no easy to handle then. The good thing is that we keep under cotrol the losses during hard moments, and we let the profits to run with those Markets that have favorable conditions. Even the Stocks Market acted in a very strange way in the last few months (I'm talking about the US Market), we will speak about it in the next newsletter.

Contact me for any question you have: info@iaminwallstreet.com

If interested in our other studies and services, please visit the website:

You can read the previous Newsletters following this link:

Best Regards,

Daniele Prandelli

I Am in Wall Street Ltd

e-mail: info@iaminwallstreet.com

Skype: I Am in Wall Street

http://www.iaminwallstreet.com

http://www.iaminwallstreet.com

High Probaility Trading Techniques - S&P500, 30 Year Treasury Futures Bonds, Crude Oil, Gold, Corn, Soybeans, Wheat, Forex, Stocks, Silver, Live Cattle and S&P/ASX200.