First of all I want to speak about the S&P500. I made good forecasts, the work is hard, so I will show you just the UPDATES that I sent to the Subscribers of the 2013 Bulletin.

This is what I said in the update of 16 February 2013:

Statistically

in February we should see a descent where we will have a new opportunity to

enter LONG at lower prices, and at the moment the favorite dates are around

23-25 February or March the 1st. The market is arriving with a top

area around February the 18th, and this can be a good change in

trade date to see lower prices in the next days.

Looking at the Market, this information was very useful:

As you can see we have seen the High on 19 February, and a new buy opportunity between 23-25 February or 1st March. Then we have seen higher prices as forecasted.

Then I sent a new update on 2 April:

If you read

the Bulletin, you can see that it was forecasted a High around 15-18 March. The

market went up till 15 March, and then it begun to move a bit down, and then

lateral. I have been very disappointed to not see the descent expected after 18

March till 4 April, because my studies were strong. But we cannot control the

Market and we have to accept it. Also, if we give a look at the European

Markets, for example the DAX30, we can see that my forecast was great, with a

High on March the 15th and then fall, hence I thought that my

forecast was not so wrong, but the S&P500 didn’t give me money after 15

March, remaining sideways, with new Highs in the last days.

I was

waiting lower prices around 4-6 April (look the Bulletin), but it is evident

now that the S&P500 Index is continuing to push up and today, at the

moment, it is at 1573 points. We can say that my swing forecast has been wrong

in the last two weeks (and very stressful for my personal trading, where I was

waiting a down trend that never arrived).

Hence, we

have to understand the next possible movement. My interpretation of this

movement is that the S&P500 is very strong. The PFS is almost ready to turn

up now, after 4-6 April. I would like to follow this up push to see higher

prices around mid-April. To confirm this possible scenario, I would be happy to

see a brief descent after the High of today, with lower prices around 4-6

April. In this case then we may see the up push suggested by the PFS, with a

High around 12-18 April. Look at the PFS and follow it, it suggests then a

possible new up push around 24-26 April till first week of May.

Looking at

important prices to manage the position, area 1534-1539 and area 1523 should be

important supports for the S&P500. Also 1539 has a good energy. Looking at

some resistances, there is 1579-1580 and 1605-1610.

And now have a look at the Market:

Even in this case the forecast has been great, in real time, where a top was forecasted on April the 2nd, and a Low with BUY OPPORTUNITY around 4-6 April (Low on 5 April). Read the Update and watch the chart. Also, at the end, I wrote that "1539 has a good energy", and the Low has been 1539.50 points... no bad!

Does It mean I'm infallible? Not at all! Because I was waiting the High on May, around the 3th, and when I saw the S&P500 goes toward 1609 points, everything looked perfect. BUT, exactly on May the 3th, the S&P500 JUMPED above my important level at 1609 points. I waited to see if the Index was able to return under my important level, but after 3 days above it, I had to give up the hope to see a change of the trend. And in this occasion I have to say that I have been totally wrong! But ok, it happened to Gann as well, so it can happen to me too. Seriously, I had really strong studies that told me to forecast a top in that date, but a change of energy is happened, and the jump above 1609 was the signal that the market had to go up. I was really surspised to see the continuation of the up trend, and I have not traded the last up push. But now we have reached my main target, as I said exactly in November 2012... so, maybe, we can hope for a stop of the uptrend, but we have to follow it day by day.

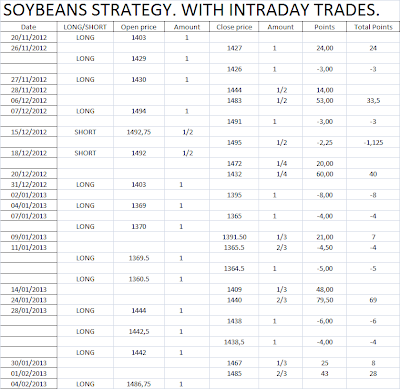

What about the Commodities: Soybeans is my King, as someone said... (do you know Gann?)

I want just to let you know that I'm trading the LONG side from 1386 points, now it is at 1473 points. We are following the uptrend (forecasted) with a profit of 64 points just in the last 4 days at the moment. Just to say that from November we are in profit of 320 points!

And what about Corn? Corn is not giving me so much satisfaction as Soybeans does, because it is less volatile, anyway, we are having good performance with this Commodity. From November we are in profit of 123 points.

And there is a news: now I'm giving analysis also for GOLD! It is a price study for the mid and long term. Well, I started to do it a few weeks ago, but the first information that I gave has been very useful! This is what I wrote on May the 9th:

Starting from the next Weekly Report I will insert a study of the prices for GOLD. It will be not a forecasting study, it will be a prices study to have confirmations of the trend. At the moment I can say that Gold is not in a strong position. Above 1483 it becomes stronger, under 1444 becomes weaker.

Well, when I said this, Gold was at 1465 points... today it is at 1375 points. I gave also a possible target price of the descent... we will see if I'm right.

But the strongest forecast is on the Soybeans... too soon to speak, we will see... but, have a look at the Soybeans Contract... Subscribe my service if interested, to see in advance all my forecasts and strategies.